Sales Tax for Stripe

Last updated: Jan 15, 2024

Zamp is the perfect companion to Stripe when it comes to sales tax reporting and filing. Our integration performs a live sync of your Stripe Invoice transactions.

When Zamp receives your invoice data, we automatically detect taxability of the transaction's details based on how you've configured them in Stripe. This allows us to build a complete and accurate summary report within our software.

After receiving your invoice data, our summary reports allow our teams to account for variances and verify data integrity. This all occurs before and during filing your sales tax returns in each state you hold liability. This is all a part of our solution's white-glove experience, informing you every step of the way.

Options to calculate with Stripe

While Zamp provides you with reporting and transaction sync, you'll still need to calculate for your invoices before payment.

Stripe does not provide a solution for calculations out of the box for invoices, but does offer two options to calculate sales tax:

- Stripe Tax (recommended)

- Manual tax amounts

Stripe Tax offers a similar experience to Zamp's API calculations endpoint. It'll require an origin, take product taxability into consideration, as well as determine whether or not to return a sales tax amount based on your nexus responsibilities.

Using a manual tax amount requires a bit of a lift, and is more often catered to specific situations when there are customizations at play to your invoicing experience. This could be including alternative calculation solutions, internal engineering requirements, or custom accounting features adopted by a business.

Integrating Zamp with Stripe

Zamp provides you with a dedicated Onboarding & Account manager, both of which are available to walk you through integrating Zamp with Stripe!

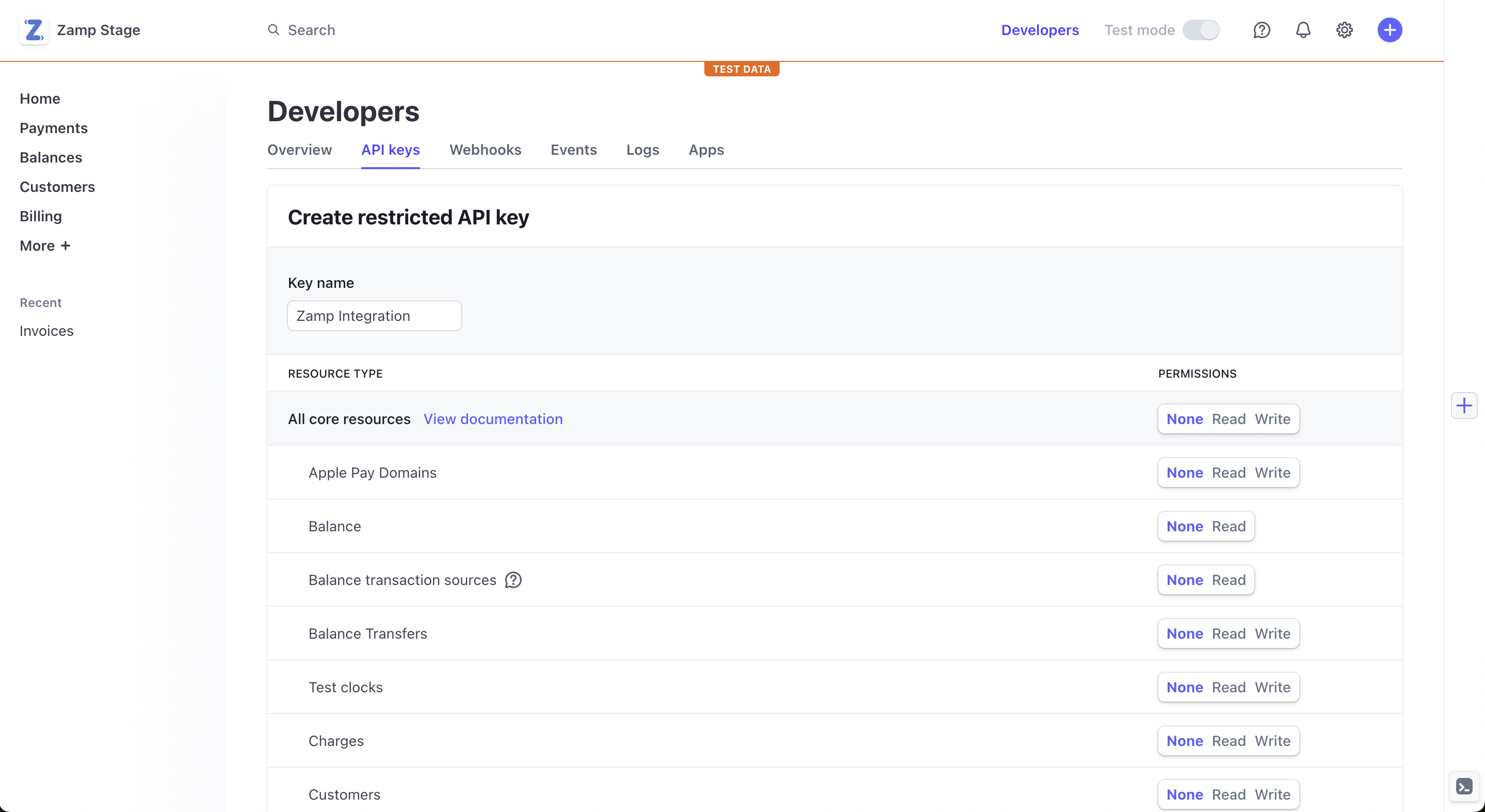

When you start with Zamp, we'll go through a detailed review of the systems you use. When Stripe is one of them, the Zamp team will walk you through creating a Stripe Restricted Key.

Restricted Keys offer a limited-access experience to give Zamp just the data we need to work with. These include:

All core resources→ Read accessAll billing resources→ Read accessAll webhook resources→ Write access

Once the restricted key is available, our team will enter it on the backend of our system. An automatic backfill of transactions to the first of the previous calendar year will be imported into Zamp. From that point forward, invoices will sync live to our software.

Filing sales tax for Stripe

Zamp's integration for Stripe guarantees we have all transactions up to the minute. When it comes time to file, we build out detailed summary reports internally that our industry-expert filing team uses to review and file with ease.

We'll contact you before we commit your business's filings to verify and guarantee accuracy, giving you a chance to reconcile what we have with you see in your Stripe records or internally recorded data.

Interested in learning more, or seeing it in action? You can contact us here. We'd love to chat!