Sales Tax for Shopify

Last updated: Jan 15, 2024

Sales tax is complex, and Shopify understands that. Shopify has a built-in sales tax engine to handle calculation and collection based on the nexus conditions you provide to it.

What Shopify doesn't do, however, is handle remittance and filing. This is where Zamp comes in. If you don't know where you have physical or economic nexus, it can be pretty difficult to configure Shopify's sales tax engine correctly - but we can help!

Zamp brings a strong customer experience with a fully managed solution. We've also got a team that possess a high-level of sales tax expertise in all areas: from tax research and calculations, all the way to filing and remittance. To add to that, we've got a Shopify integration.

Zamp's integration with Shopify will take in your transaction data and build out summary reports by state, which enables you to do a few things:

- Build your complete economic nexus picture

- Assists you in performing sales tax reconciliation; and

- Be ready for state sales tax filing and remittance, based on your filing frequencies.

Options to calculate with Shopify

While Zamp does offer an API for on-the-fly calculations, Shopify has its own sales tax engine that we recommend using. We strongly encourage Shopify merchants to configure it accurately.

As a starting point, Shopify's Help Center has a manual around taxes here. It takes you through an understanding of tax liability, nexus, and registrations. If you're interested in some further reading on these topics, we also offer some additional detail in our Resource center.

Once you've determined where you need to enable sales tax collection, Shopify has a guide on "Setting up US taxes". Zamp also offers some documentation around enabling or disabling sales tax collection here. These are things that Zamp's dedicated Onboarding & Account managers can assist in advising on as well, based on a detailed nexus analysis.

Integrating Zamp with Shopify

Part of Zamp's focus includes getting you integrated as quickly and smoothly as possible. Our Onboarding & Account managers will walk you through setting Shopify up and ensuring your transactions flow into our system.

There are just three things we need to connect to your Shopify store, all of which the Onboarding or Account manager will collect:

- the Shopify Store URL

- an Admin API access token; and

- the API secret key

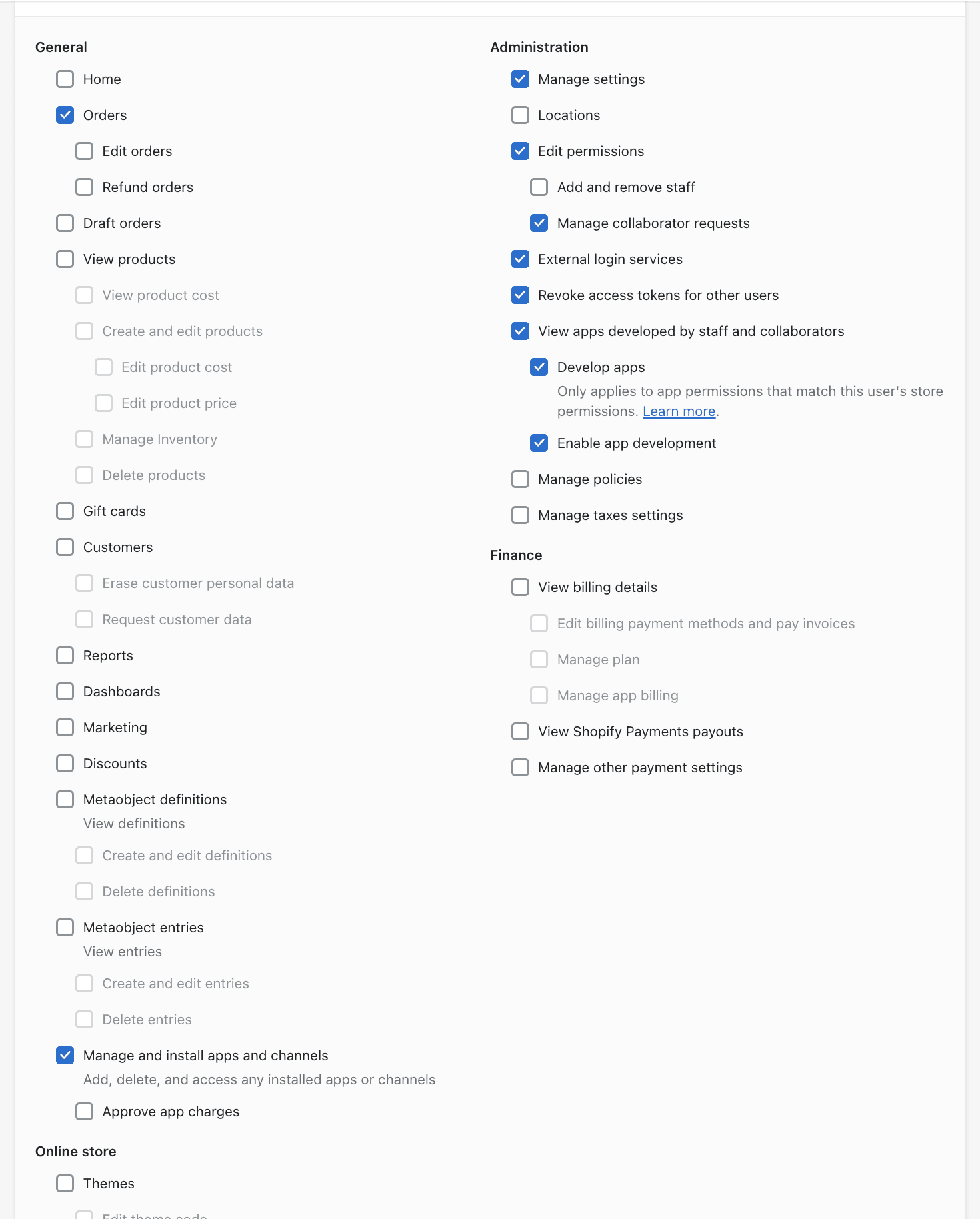

We'll also walk you through the necessary API scopes and permissions that Zamp needs during the access token's setup.

Once we get connected to your Shopify store, Zamp will automatically backfill historical transactions so we can do an accurate nexus analysis.

We'll also take care of ensuring any marketplace transactions are appropriately marked (such as those from Amazon or TikTok Shop and beyond) and map your products to Zamp's tax codes. This is all a part of Zamp's managed solution!

Filing sales tax for Shopify

Once we've got your Shopify store integrated with Zamp, our software will begin building state summary reports. These reports are used by us to let you know what the liabiltiy is for each state, and then file and remit.

Any time there is an upcoming filing, we'll give you a heads up with what amounts we have on record. This gives you a chance to reconcile and verify all before our filing team handles the rest.

If you're a Shopify seller and puzzled navigating the sales tax space, we'd love to chat with you! Get in touch with us.